Welcome to our ‘Fund in Focus’ series where we profile our member funds, underscore their investment philosophy, and highlight some of their interesting work. Today we speak to Kiran Mysore, Principal, University of Tokyo Edge Capital Partners (UTEC). In this feature, Kiran delves we delve into UTEC’s remarkable journey as one of Asia's leading deep-tech venture capital firms. With a focus on profound science and technology, UTEC is empowering startups to pioneer innovations that can transform the world. Discover their extraordinary success stories, investment strategy, and insights for entrepreneurs seeking UTEC's support.

Fund in Focus: UTEC's Hands-On Approach to Deep-Tech Investing in India and Beyond

1. Can you provide an overview of University of Tokyo Edge Capital Partners (UTEC), including its history, mission, and core investment philosophy?

We are a Japan-based VC firm doing hands-on lead investments in global science and deep-tech startups. Often regarded as one of the largest deep-tech VC firms in Asia, we have raised 5 funds with a cumulative AUM of 85 Billion Yen. Our most recent fund is UTEC 5, a 30 Billion Yen fund that we raised in June 2021. Our previous fund UTEC 4 was ranked by Preqin JVCA VC fund benchmark as the top-performing Japanese VC fund among the ones with a fund size of $100M+.

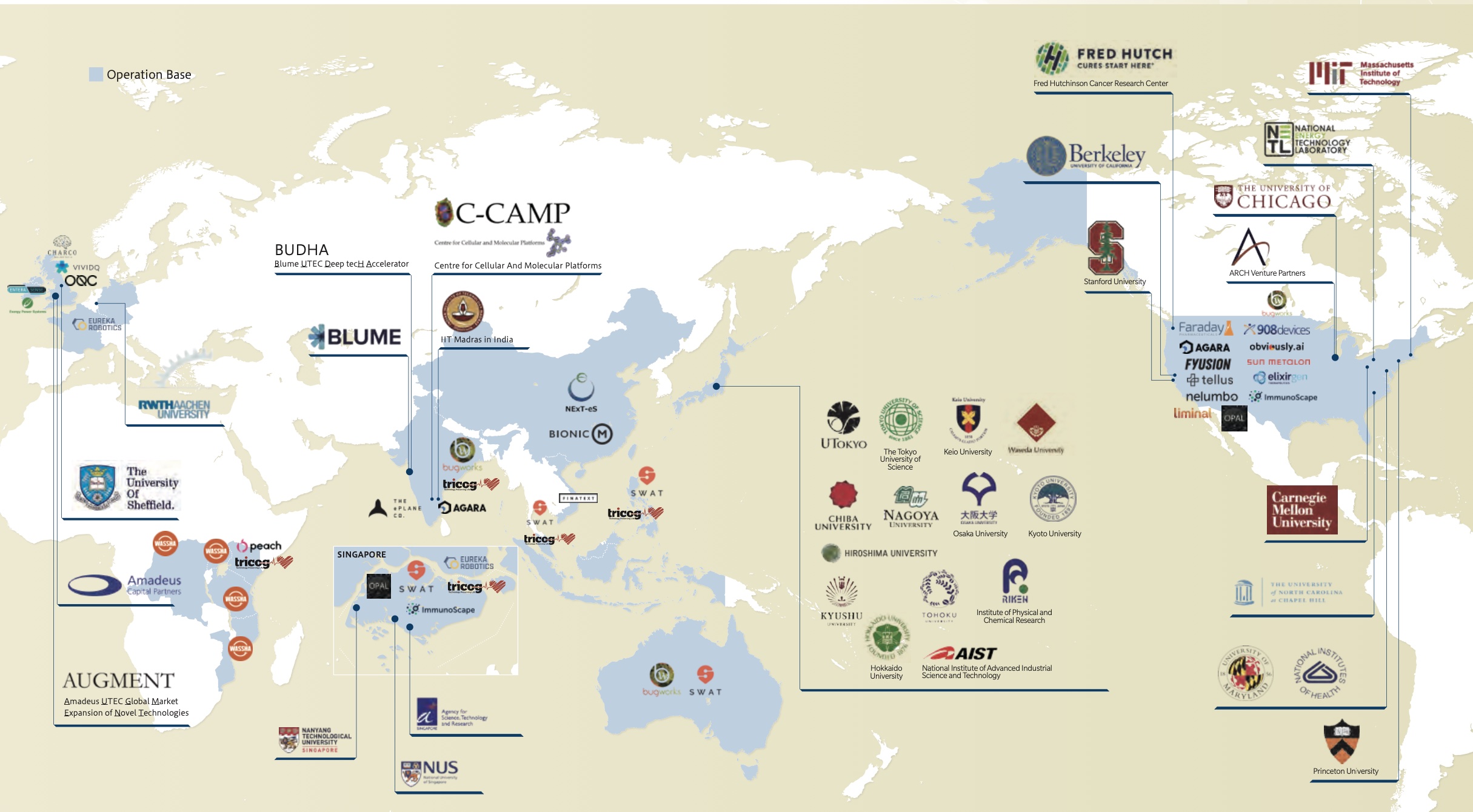

We are an independent VC firm that raises LP money from institutional investors, but we work closely with universities for deal sourcing and value-add. Our closest association is with The University of Tokyo, but we have worked with spin-off companies from several Japanese and Global universities (refer to the infographic).

UTEC was founded in 2004, and since then, we have done over 150 investments with a track record of 20 IPOs & 20 M&As. Some of our success cases: PeptiDream (listed on TSE in 2013), Finatext Holdings (listed on TSE in 2021), ACSL (listed on TSE in 2018), 908 Devices (listed on NASDAQ in 2020), and Oriciro Genomics (acquired by Moderna in 2023)

Our mission is to create new industries, to solve global issues of humankind, by bringing together capital, talent, and knowledge, around science and technology.

2. What sets UTEC apart from other venture capital funds in terms of your investment strategy and approach?

Broadly speaking, UTEC focuses on investments in three areas:

Healthcare and Life sciences

AI and IT

Physical sciences and Engineering

We especially look for fundamental IP-driven companies that address some of the most important global issues such as aging population, labor shortage, digitization of legacy industries, climate change, etc. We are seed/early investors. Our first check size is about $500,000 to $5 million with a strong commitment as lead investors, and we can invest ~$15M as follow-on capital over the lifecycle of the company.

We often work with researchers in university labs to incubate the company at the pre-company formation stage and help them with: Proof of Concepts, Business Plan, Team Building, and then help them set up a corporate entity – a ‘Venture Creation’ model. In addition, we have built a platform team of experts to offer hands-on support to our portfolio in the following: Research Collaborations with Global Academia, Japan/Global Market Expansion, Recruitment of Global Professionals, Collaborations with Japanese and Global Corporations, and Follow-on Fundraising from Japanese and Global Investors. Furthermore, we at UTEC often work together with governmental agencies to help craft innovation-friendly policies. UTEC’s Managing Partner & CEO Mr. Tomotaka Goji was elected as the Chairman of JVCA (Japan Venture Capital Association) in July 2023.

3. UTEC is based in Japan. How does your fund approach global investment opportunities, and which sectors are you particularly focused on in India? Could you share any future plans?

Since 2018, we have increased our investment in overseas deep-tech startups that possess strong synergies with Japanese industries and academia. While most global VC firms often view emerging countries merely as large market opportunities, we firmly believe that these countries can be hotbeds for globally competent innovation. In fact, we have made 10-15 deep-tech investments in emerging markets such as India, Southeast Asia, and Africa.

India might be the only emerging economy with deep-tech innovation that can rival Silicon Valley. It boasts world-class universities and research labs (including corporate labs), but at a much lower cost structure and with a culture of frugal innovation. The Indian startup ecosystem also shares elements with Israel's. For instance, much like Israeli startups, Indian companies always have global aspirations. Moreover, India's B2B market, though not small, is steadily growing, drawing parallels to China. The combination of these factors makes it very appealing for a global fund like ours.

Furthermore, India and Japan are natural long-term partners with complementary strengths. The software innovation of India, combined with the hardware and infrastructure capabilities of Japan, is a perfect match. In India, we are keenly exploring sectors such as Manufacturing and Robotics, Automotive & Mobility, Generative AI applied to legacy industries, and IP-led healthcare/Biotech innovations.

4. Could you share some notable success stories or portfolio companies in India that UTEC has supported and the impact they've made?

We see two types of deep tech innovations in India – addressing both local and global markets.

Science-led Innovation:

This is based on fundamental research and often originates from academic labs of universities or researchers who have worked in R&D departments of large corporates for several years. They push the boundaries of science, and can be categorized as new discoveries. We are one of the earliest and largest investors in Bugworks Research - a great example of this. Bugworks has platform technology combining medicinal chemistry, structural biology, and computational modelling that has given rise to multiple drug assets to tackle the global problem of AMR (antimicrobial resistance) and oncology. They recently became the first company in the world in Phase 1 stage to partner with Global Antibiotic R&D Partnership (GARDP), an initiative by World Health Organization.

Another example is our portfolio The ePlane Company, which is building the most compact eVTOL aircrafts in the world to address of the problem of mid-mile mobility and logistics. The startup was incubated at IIT Madras and its work is based on decades of research in aerospace by Dr. Satya Chakravarthy, a professor at IIT Madras.Engineering-led Innovations:

They combine elements of engineering, design, software, mathematics, and other fields to make the product work in the real world. Our portfolio company Tricog Health falls in this bucket. Tricog offers AI-driven analysis of ECGs (electrocardiogram) and echocardiograms to diagnose heart diseases in India, SEA and Africa, touching 12 million patients. They combine decades of experience in cardiology, embedded systems, and deep learning. Similarly, UTEC’s portfolio Agara that leveraged deep learning to build fully autonomous voice agents for customer support was acquired by Coinbase in 2021.

5. How does UTEC envision the role of venture capital in shaping the future of technology and innovation in India? Japan has a growing start-up ecosystem. Any similarities or differences you have noticed between Japanese and Indian start-up ecosystems?

We firmly believe that synergizing Indian deep-tech startups with Japanese industrial and scientific collaborations can pave the way for global success stories. For instance, our portfolio company, Tricog Health, recently secured strategic financing from Japanese conglomerates, Omron Healthcare and Sony, to expand their solutions worldwide. Similarly, Bugworks Research enjoys a fruitful collaboration with the Tokyo Institute of Technology. Their joint R&D endeavors have even led to a research publication in Nature Communications.

India's deep-tech innovations hold the potential to influence over 5 billion lives in the emerging world. Some of these innovations might also find relevance in developed nations, particularly with the emerging trend of Reverse Innovation. The global community stands to gain immensely from more problem-first deep-tech startups from India. These startups can address the pressing global challenges, especially in today's world marred by conflicts and confrontations. While the first wave of Indian startups was consumer-centric and the second wave heralded the rise of Indian SaaS, we are now witnessing the third wave—The Golden Era of Indian Deep-tech. There's a clear parallel between the trajectory of Japan's deep-tech startup ecosystem from the past decade and India's current deep-tech landscape, where pioneering success stories are just beginning to emerge.

6. How does UTEC identify promising startups to invest in, and what criteria do you consider when evaluating potential investments? For entrepreneurs and startups seeking investment from UTEC, what advice or tips can you offer to stand out and make a compelling pitch?

Our investment criteria has remained consistent for the last 19 years: a) Profound Science & Technology, b) Strong and diverse team, c) Addressing the global issues of humankind.

We've initiated collaborations with incubators at several universities and research institutions in India, including IIT-Madras and C-CAMP Bangalore, and have engaged with their spin-off companies. We also develop 'theses and themes on technology inflection points' and proactively reach out to researchers and entrepreneurs. A notable example is our investment in the US/India-based startup, Obviously AI, which stemmed from our 'democratization of AI and future of work' thesis. Moreover, we adopt a collaborative stance in our India-related activities, working with various early-stage VC firms in the country such as Blume Ventures. This synergy blends UTEC's deep-tech expertise with the local market knowledge of Indian VC firms. From our experience, the cornerstone of a deep-tech startup's success in India, whether they're driven by science or engineering, lies in adopting a problem-first approach. Combining technological prowess with operational excellence is crucial, and these are the attributes we seek in a compelling startup pitch.