Welcome to our 'Fund in Focus' series where we profile our member funds, underscore their investment philosophy, and highlight some of their interesting work. Today we speak to Anjani Bansal, Partner and India Country Head of the Japanese VC firm - Global Brain. With him joining Global Brain, the VC firm is all set to step up its operations in India. Bansal in the interaction throws light on Global Brain being one of the few GPs that manage a pool of multiple funds of global corporates with specific investment strategies and the rising sentiment among CVCs towards Indian start-ups in recent times.

Fund In Focus: Multiple CVC funds backed Japanese VC Firm - Global Brain, is bullish on investing in Indian start-ups.

Anjani Bansal, Partner & India Country Head, Global Brain

Spokesperson: Anjani Bansal, Partner & India Country Head, Global Brain

1. How would you describe the investment philosophy of Global Brain?

It is fairly straightforward - we invest in strong teams solving large problems with deep revenue pools yet to be unlocked. Over the last 25 years, we have developed muscle memory from successes and failures from investing across multiple sectors in SE Asia, North America, Europe and Japan. We try to understand the mental model of founders and their vision for the company. Combining that with their ability to execute, helps us estimate the probability of them turning a product in to a large company. We invest in Pre-Series A to Series B rounds.

Furthermore, we assess our own ability to help the team. We have a deep network of Japanese corporates operating in global markets. This provides unique opportunities to startups for cross-border expansion and strategic partnerships with large multi-nationals. Our team of experienced operators and investors has a proven track record of nurturing innovative and ambitious companies. We look at each company to determine areas where we can provide meaningful support.

The global context has become highly uncertain driven by risks from pandemic, climate change, geopolitics, inflation, etc. We believe that in such uncertain times lies the greatest opportunity, and that the power of startups is vital to overcome unprecedented situations.

Partnerships with corporations is crucial for startups to achieve rapid growth. Coupling innovation led by startups with operational expertise and scale of corporations, is more likely to bring about large scale transformation. We leverage our deep network with global corporations to unlock such opportunities.

2. Apart from your own fund, Global Brain also manages several corporate's investments into startups. This makes it a unique fund. We are keen to know how you liaison with these corporates. Which - sectors, stages, solutions, etc. - are they looking into for investments? What's their take on the new crop of Indian start-ups?

Globally, we are among very few GPs that manage a pool of multiple funds with specific investment strategies. We manage thirteen funds - our core sector agnostic fund, and twelve CVC funds backed by global corporates such as Mitsubishi, Sony, Mitsui, KDDI, Epson, etc. CVC funds have specific investment thesis based on strategic priorities that we have agreed on with each corporate.

Frequently, we pool monies from multiple funds into an investment depending on interest from the founders and funds' investment thesis. For example, a fintech startup building wealth management products for Gen Z in India could have synergies with one of our CVC funds where the strategy includes building such products for markets in Southeast Asia or Japan.

Our CVC funds span multiple sectors such as financial services, telecom, infrastructure, electronics, agritech, food and healthcare. We invest across Series A-C and have higher threshold for investment duration from these funds.

Overall, the sentiment of CVCs towards Indian startups is very bullish. There is strong appreciation of high quality of Indian founders who are building for the world's fastest growing large economy. The conviction is further strengthened by growing exit opportunities through M&A and IPOs in India.

3. How do you identify your 'winning' start-ups? With Global Brain's India office being set up in Bengaluru recently, which kind of sectors, innovation or products which will interest you to invest in?

While we are a global fund, India is clearly the top priority region for us going forward. We believe there is strong growth potential in the economy, and that affluence of its large population with continue to increase. This will unlock large demand for products and services, and use of technology will be the most important lever to serve this market. India has a lot going for the country:

Growing startup ecosystem:

Already global #4 VC market by size (~$15B)

Global #3 in number of Unicorns (~85 in 2022)

Large working population:

The largest population (~1.4B) in the world

Median age is 28.7 years, compared to 48.6 for Japan

India will be the world's future talent factory as it will have 20% of the globe's working population by 2047

Country leapfrogging with digital:

Already one of the largest and fastest-growing markets for digital consumers ( 850M internet users)

Smartphone penetration is still ~45%. Next billion will be “digitized” in coming years

Growing M&A and IPO market:

Successful startups are buying other startups, and traditional large companies are buying new age startups

We are particularly excited about certain broad themes. Markets of Tier II+ India is primed for growth in both existing and new products and services. We like founders who are building for this large segment. This could include building blocks such as connectivity, social networks, supply chain and marketplaces. Product development, Distribution and Customer Acquisition require a differentiated approach in these markets.

Wealth Management, Insurance and Lending for specific customer segments such as Gen Z, Middle income segment and MSMEs are exciting. Modernization of agriculture in India through technologies such as remote sensing and drones, and scaling up of export markets in high value commodities is another great opportunity. Noncommunicable diseases, Primary health care, and Diagnostics in regions not served by large hospital chains present important problems that can be solved for big markets.

We are also bullish on certain emerging areas in India such as Space and Lifesciences. Climate tech is an important part of our global portfolio and we are keen to identify next set of investments from India. India plays a critical role in solving the challenge of climate change globally, and we hope to support Indian entrepreneurs taking on this problem.

4. This year completes 25 years for Global Brain. How would you describe the transformation of investment landscape over the years while throwing light on the European, the Indian subcontinent and the Southeast Asia regions?

Over the last two and a half decades, we have experienced a number of crises including the dot-com bubble and the global financial crisis. But with each crisis, great startups have emerged and created new opportunities. We are entering a difficult period in the investment environment, but historically speaking, our global presence and experience tells us that this is a great opportunity.

We have 10 offices in 9 countries, and our strength is our ability to formulate strategies flexibly based on insights drawn from each region. We prioritize investment areas and regions based on our continuous assessment of markets and underlying opportunities. Startups building in certain areas that will shape our collective future, such as Life Sciences, Healthcare Devices and Climate Tech, are particularly exciting to us.

Same applies to our fund management strategy. We pursue diversity in funds that we manage, such as sector agnostic funds dedicated to certain regions or stage, and CVC funds backed by global corporates with strategic priorities. India is clearly our top priority region.

5. Any investments made so far in India? Tell us about the exciting work done by some of your portfolio companies here in India.

We have invested in multiple sectors in India. It's a very exciting portfolio and foundation of our growth in India. Some of our investments include:

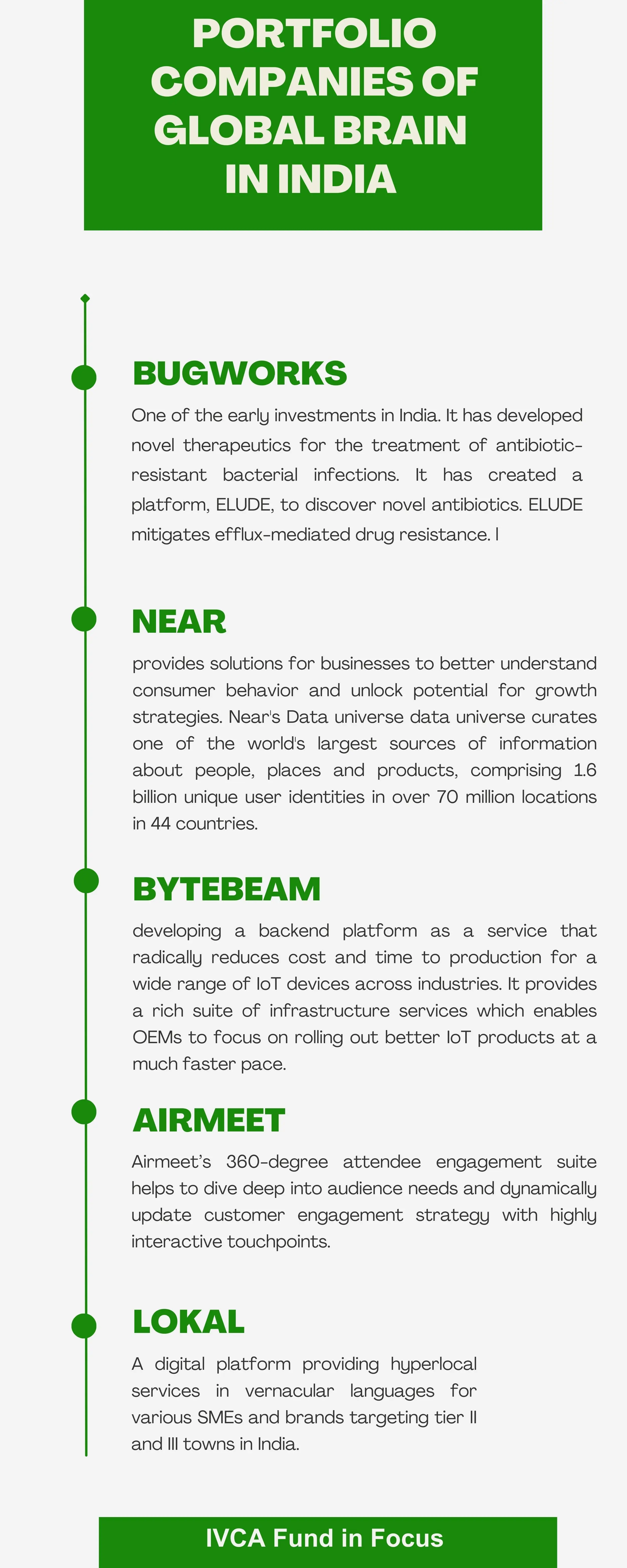

Bugworks is one of our early investments in India. It has developed novel therapeutics for the treatment of antibiotic-resistant bacterial infections. It has created a platform, ELUDE, to discover novel antibiotics. ELUDE mitigates efflux-mediated drug resistance which is a critical barrier in Gram negative bacteria. Bacterial infections are becoming resistant to antibiotics, posing a fast-growing public health threat worldwide, leading to increased mortality and morbidity, longer hospital stays, and increased health care costs.

Near provides solutions for businesses to better understand consumer behavior and unlock potential for growth strategies. Near's data intelligence solutions serve both operational and marketing data leaders, whether they are shopping, traveling, dining, tourism or product purchases. Nearvs Data universe data universe curates one of the world's largest sources of information about people, places and products, comprising 1.6 billion unique user identities in over 70 million locations in 44 countries. With strategic and exclusive data sets and customer partnerships, Near aggregates multiple data sources across data types and uses deep learning to better understand consumer behavior. , leveraging the company's AI-driven model.

ByteBeam is developing a backend platform as a service that radically reduces cost and time to production for a wide range of IoT devices across industries. It provides a rich suite of infrastructure services which enables OEMs to focus on rolling out better IoT products at a much faster pace. These services include synchronising data across devices and mobile app, visualizing analytics and insights to optimize performance, remotely diagnosing device failures and rolling out bug fixes and over the air updates. The platform has security and privacy features such as device level data encryption and role based access.

Airmeet has built an immersive engagement suite that empowers businesses and communities to connect with their audience, engage in meaningful conversations, exchange feedback, and build long-lasting relationshipsthrough events. Airmeet's 360-degree attendee engagement suite helps to dive deep into audience needs and dynamically update customer engagement strategy with highly interactive touchpoints. It's functionality, customization and data security are best in the market.

Lokal is a digital platform providing hyperlocal services in vernacular languages that are tailored for population in tier II+ cities and towns in India. It offers unique content-led digital marketing solutions for various SMEs and brands targeting tier II and III towns in India. As smartphone and internet use continues to grow, Lokal is building for the underserved market that requires a more differentiated approach as compared to metros of India.