Welcome to our ‘Fund in Focus’ series where we profile our member funds, underscore their investment philosophy, and highlight some of their interesting work. Today we speak to Arvind Agarwal to learn about

investment stage which is ‘similar to a VC strategy but with a PE approach'. He further highlights in this interview how the fund has inculcated gender as an integral part of its investment and business processes and has also encouraged its portfolio companies to implement appropriate gender strategies for their businesses.

Fund In Focus: C4D Partners' Impact 'Bharat Shubharambh Fund', Continues to Garner Interest from global DFIs; Eyes at Achieving its First Close by September '23

Arvind Agarwal, Founder & CEO, C4D Partners

1. How would you describe C4D Partners’ investment strategy for a diverse market like India?

Indian economy is driven by the Micro, Small & Medium Enterprises (MSME) segment. The MSMEs have been playing a remarkable role in the emergence of the Indian economy. India needs large investments in the secondary economy to boost the manufacturing segment. India can raise its manufacturing competitiveness and become a supplier of choice for its large consuming class and global markets. The availability of capital is the biggest obstacle to India's manufacturing sector. Unlike the tertiary sector, the secondary sector requires patient long-term investment. While the manufacturing sector has great potential, most investors are reluctant to venture, owing to the investment required in money, time, and effort. But this is what a developing country like India needs.

C4D Partners is an early-stage private equity growth fund. C4D's investment stage is similar to a VC strategy but with a PE approach. We invest in Pre-series A, Series-A, and Pre-series B stages. Usually, in this stage, the companies are not operationally positive and are looking for long-term growth capital with technical assistance. Therefore, at C4D Partners, we provide patient capital to our portfolio and emphasize guiding businesses to create a sustainable impact for society and have good exits for our investors.

2. Enterprises globally are working towards making Sustainability an integral part of their DNA. What, in your opinion, are the driving factors in India resulting in private capital being infused into ESG-focused enterprises?

As rightly mentioned, there has been a recent surge of interest in ESG-focused enterprises, but we believe that ESG should already have been an integral part of all businesses by now. However, this new-found attention can be attributed to the enormous climatic changes that are being witnessed across the globe. As innovative companies are cropping up to offer solutions to these environmental and social challenges that are increasing by the day, investors are finding not just monetary value in such businesses but also an opportunity to generate positive social returns. In fact, a report by NYU Stern has stated that ESG-compliant companies deliver higher financial returns in the long run. Further, ESG-compliant companies aid in lowering the risk of business failure by providing downside protection, especially during the social or economic crisis. Therefore, investing in businesses that will create sustainable growth is only reasonable.

3. C4D's existing Asia Fund has seen 42% of the AUM being invested in women-owned and women-led enterprises. Highlight interesting work by some of your portfolio companies.

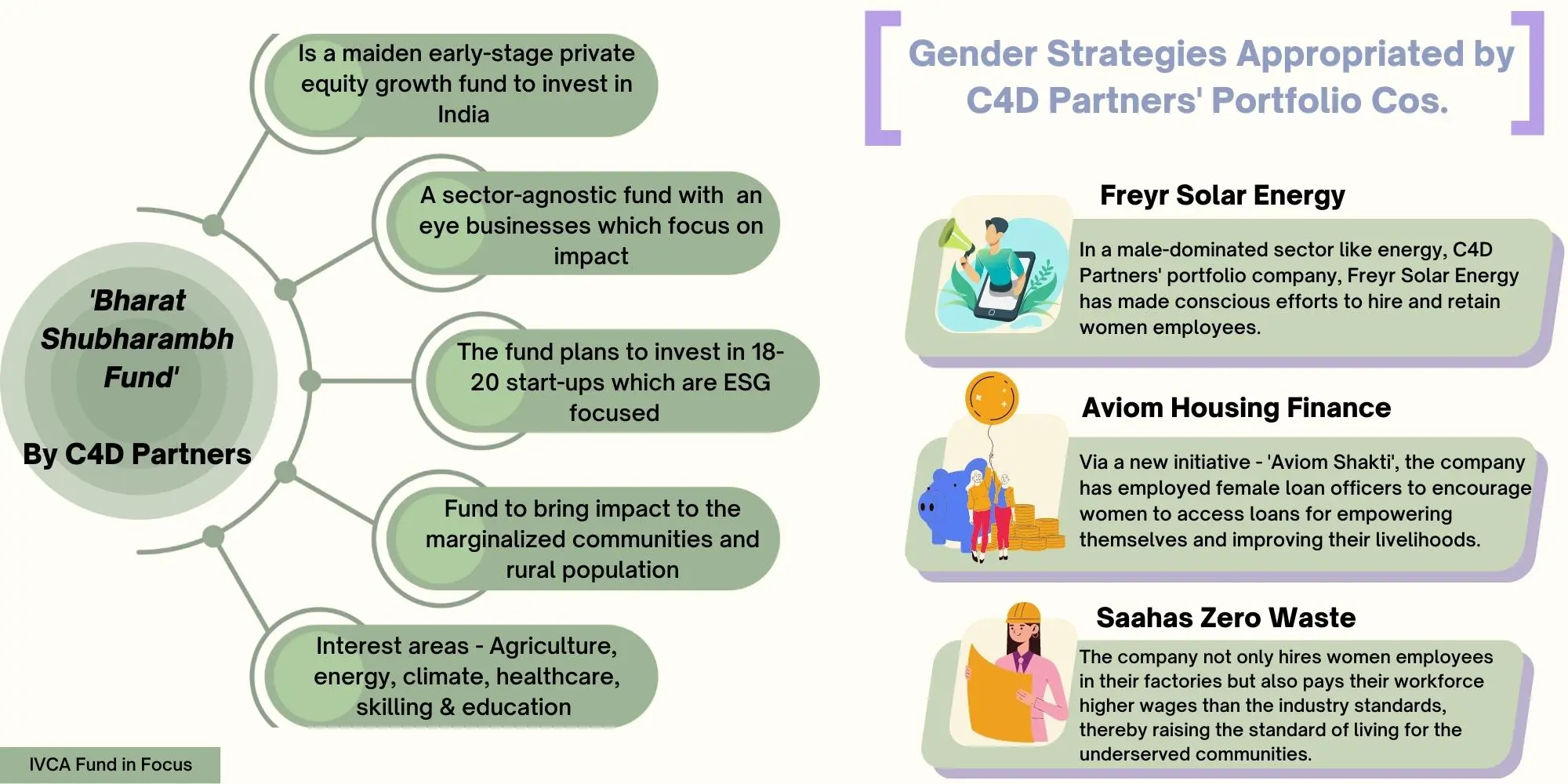

At C4D Partners, gender lens is seeded in our business and investment processes, and one can witness it in our portfolio as well as in our team. We not only employ gender strategies in our functioning but also guide our portfolio companies to identify and implement appropriate gender strategies for their businesses. Most of our portfolio companies are highly gender responsive and have taken initiatives to encourage the participation of women in business at all levels. For instance, in a male-dominated sector like energy, our portfolio company Freyr Solar Energy has made conscious efforts to hire and retain women employees. Similarly, another one of our companies, Aviom Housing Finance, has dedicated loan services for women customers in rural areas. Through their initiative, Aviom Shakti they have also employed female loan officers to encourage women to access loans for empowering themselves and improving their livelihoods. Speaking of livelihoods, our investee company, Saahas Zero Waste, not only hires women employees in their factories but also pays their workforce higher wages than the legal mandate or even industry standards, thereby raising the standard of living for the underserved communities. We are proud to cite such initiatives by our investees, who are working towards achieving gender transformative goals and are as driven by the purpose of creating meaningful impact as we are.

4. Recently, C4D Partners launched their maiden fund – 'Bharat Shubharambh Fund' ($50M), for investments in Indian start-ups. Tell us how you plan to deploy this capital.

The C4D Bharat Shubharambh Fund is an India-dedicated early-stage private equity growth fund. Through this fund, we seek to associate with 18-20 early-stage ventures that are ESG-focused. This means the businesses we invest in should solve an environmental or societal challenge while improving livelihood opportunities for marginalized communities and generating returns for investors. Being a sector-agnostic fund, we will not have limitations as to which industry we would be emphasizing, but as has been our stance since the beginning, we would definitely look for impact-driven businesses rather than technology-led ones. Technology can surely be an enabler in the business model but not the lead. Also, similar to our C4D Asia fund, our first fund, we will continue our commitment toward women-owned/led businesses with at least 30% capital being deployed there.

5. Any investments made so far? Will diversity play a key role in choosing your investee companies?

In India, we are invested in 11 impactful businesses through our first fund. We have worked closely with all our portfolio companies, supporting their growth over the years, and we seek to amplify this impact through our second fund. We are currently working toward garnering funds for the C4D Bharat Shubharambh Fund and reaching out to conscious investors through our network. We are happy to share that we have secured much interest from DFIs across the globe and expect to achieve our first close by September 2023. At C4D Partners, we have always emphasized diversity in our processes and practices, and we’ll continue to follow the same in our next fund. As a sector-agnostic fund, we will be investing in businesses across sectors with a key focus on agriculture & agri-processing, energy, climate, retail & consumer goods, healthcare, skilling & education, and any other industries with a substantial impact on the marginalized communities and rural population of India. Furthermore, we also focus strongly on gender diversity, committing at least 30% of our funds to women-owned/led businesses. Through our first fund, over 42% of the AUM has been invested in women-owned/led companies across Asia, and with regard to the fund’s India portfolio, this share is over 60%.

6. What are your thoughts on the 'India Opportunity ' today?

India definitely holds immense opportunities for investors and businesses today to garner great returns and create meaningful impact. Increasing mobile and internet penetration, rapid urbanization, favorable government policies for businesses, availability of a vast talent pool, and the tremendous growth of the Indian economy, leading to the expansion of consumer markets in the country, are some significant reasons for fostering this development. Though most of all, it is the people bringing about this change. The entrepreneurial spirit that has been kindled in the country has encouraged many to stay in India and contribute to society in their own ways.

7. Which are the hot sectors where C4D Partners will look at making investments in the coming year?

We believe that climate financing will take center stage in 2023. Apart from the fact that enormous climatic changes are happening across the globe, India ranks only third after China and the US in carbon emissions. Since significant carbon emissions come from energy consumption, we see much in the clean energy market. Moreover, considering that India is responsible for generating 277.1 million tonnes of waste annually, we believe that circular economy is another sustainable business model worth investing in. In fact, the Government of India has granted the maximum number of patents in these two segments, pushing for more technological innovations and the growth of green startups in clean energy and the circular economy.