#TheContext

Alternative Investment Funds – the momentum continues for Amrit Kaal

Tejesh Chitlangi

Leelavathi Naidu

Follow the Authors

‘Ease of doing business’ continues to be the theme for alternative investment space in the year that passed by. India has emerged as one of the most attractive destinations not only for investments but also for doing business. The International Monetary Fund (IMF) has raised India’s GDP growth forecast for FY 2024-25 to 7%. Global institutions are increasing their allocations/investments in SEBI-regulated alternative investment funds (AIFs).

As the country's economic landscape continues to transform, AIFs have emerged as a pivotal force in channelising investments in Indian enterprises and driving innovation across various sectors. The AIF segment in India has seen remarkable growth with over 1400 AIFs being registered and having raised over INR 12 trillion as capital commitments.

Being one of the fastest growing asset classes with an increasing importance in India's financial landscape, the SEBI (Alternative Investment Fund) Regulations, 2012 (AIF Regulations) also witnessed key regulatory developments aiming to improve transparency, investor protection and fairness as well as streamlining operational process. The year passed by, saw SEBI revisiting a fair bit of its existing regulatory norms, providing clarifications and relaxations on multiple operational issues whilst also prescribing additional regulatory norms. Ensuring good governance has been the focus of these regulatory changes so as to ensure a sustainable long term growth for AIFs. Industry did welcome clarity on multiple operational matters such as introduction of dissolution period post completion of tenure of the fund, encumbrance by AIFs of its holding of equity in investee companies, clarity on borrowing etc. However, the regulations did also prescribe additional measures to be undertaken by the fund managers viz. introduction of diligence requirement for AIF investors for meeting compliance with QIB norms, diligence pertaining to investments from countries sharing land border with India, to check investments by RBI regulated lenders ever-greening their stressed loans etc.

The recent regulatory changes requiring pro-rata participation and pari passu rights amongst investors (subject to certain exclusions/exemptions) highlight SEBI’s intent to bring parity amongst investors and enhance governance. However the fund managers may need to reassess their operational structures to deal with these new provisions and some regulatory clarity may be needed for these new prescriptions to smoothly set-in.

One of the major regulatory supports that the industry is looking forward to, is a collaborative effort between regulatory authorities, industry associations and market participants to ensure effective regulation and for maintaining the stability of the financial system.

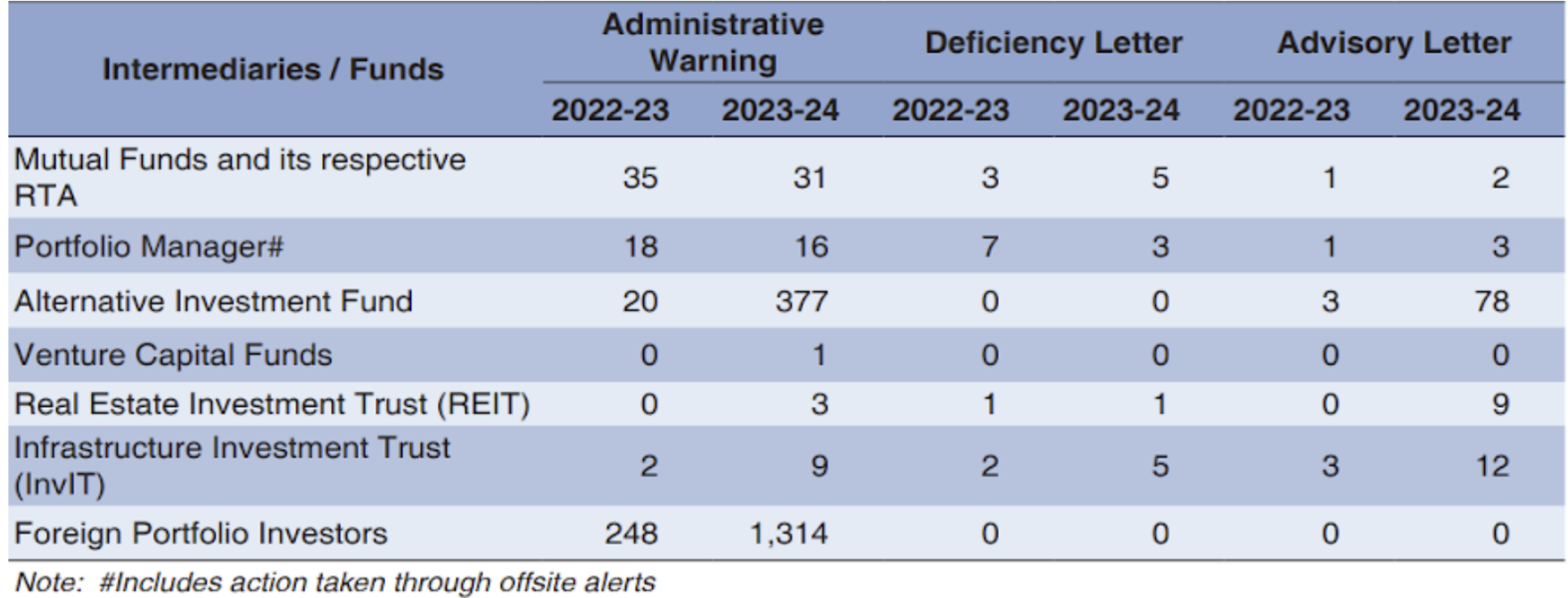

This is to address the recent concerns where the AIF industry appear to be under regulatory radar of SEBI with respect to certain compliance and governance issues. The Annual Report of SEBI (2023-2024) showcases some growing concerns in terms of count of regulatory proceedings being initiated against the AIF players vis-à-vis other intermediaries:

AIF managers however appear to revisit their compliance and governance frameworks to ensure that the regulatory expectations are met with.

AIF managers however appear to revisit their compliance and governance frameworks to ensure that the regulatory expectations are met with.

br As India's AIF industry continues to attract global attention, efforts have to be made to align regulatory frameworks with international standards and practices. This alignment shall facilitate the global investments in Indian AIFs and enhance the global competitiveness of Indian fund management industry. Promoting innovation and growth with a balanced regulatory framework remains an important ongoing objective for SEBI towards which it seems to be continuously working in collaboration with the industry players.

#TheContext by IVCA – features opinion makers from the alternate investing industry with strong focus on India as investment destination. Watch this space for viewpoints on investment themes, emerging trends, economic analysis and latest industry insights.