#TheContext

Secondaries 3.0 in India: There are decades where nothing happens and there are weeks where decades happen

Norbert Fernandes, General Partner, Kenro Capital

Follow the Authors

Norbert Fernandes

General Partner, Kenro Capital

A primer on private equity secondaries

Private Equity (PE) and Venture Capital (VC) are both well-understood assets classes in Asia. Between these 2 strategies, fund managers (GPs) in India have raised and deployed USD 400+ bn over the last 15 years, and have been responsible for identifying and funding several disruptive businesses in India, of which a handful have even gone on to IPO. PE/VC funds commonly are closed-ended with a fund life of 7 to 10 years, within which they are expected to exit all their investments are return money to their investors (LPs). However, historically, it has taken longer than this, on average, to scale a portfolio company to full potential, especially in India. This creates all sorts of issues for GPs, including a common paradoxical situation of strong NAVs (Net Asset Value – the value of assets “on paper”) yet low DPI (Distributed-to-Paid-In capital ratio – a key measure of “cash on cash” returns to LPs). As the PE/VC ecosystem matures, LPs have now started paying close attention to the DPI metric. The PE/VC equivalent of the popular eCommerce aphorism “GMV is vanity, Profit is sanity, but Cash is King” is:

"NAV is vanity, IRR is sanity, but DPI is king"

Globally, secondaries have been a critical mechanism for GPs to achieve timely DPI on investments in a structured and fair way. Secondary funds essentially buy stakes in companies from GPs ensuring a full or partial exit for their investment. In a way, they carry forward the baton from earlier investors (much like in a relay race), towards an eventual full exit (IPO / strategic sale / buyout).

Global history of secondary funds

In developed markets like the US and Europe, secondary funds are a large and well-documented asset class for several decades now.

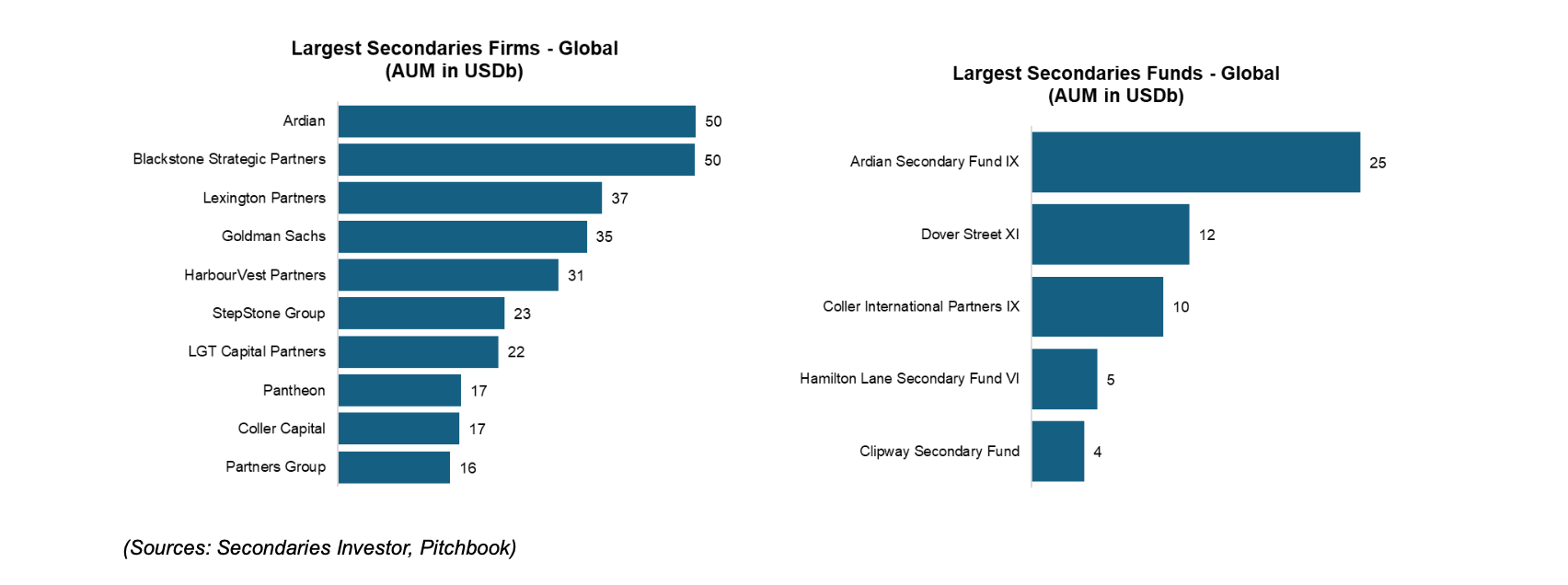

The top 10 secondary fund managers globally manage a collective ~$300b in capital. This is comparable to the total PE/VC capital ever invested in India. The five largest secondary funds raised till date were all raised after 2021, and total to >$50b. While these funds are typically less spoken and written about, the sheer numbers alone should give you a good sense of how scaled up and systemically important this asset class has become in developed markets.

Secondaries in India: A mathematical inevitability?

Secondaries become large and relevant in a market only after a critical mass of PE/VC funds have been deployed and are starting to reach the end of their fund lives. Before this critical mass is hit, secondaries funds can sometimes look like a "solution in search of a problem". But after it happens, they very quickly become a vital conduit in the capital flow machinery. Timely capital return to LPs is an increasingly important reason why investors come back to invest in next funds. Now, with adequate maturity in the market, this is also measurable and comparable across funds. Mature GPs understand this trade-off between generating DPI today vs incremental future MOIC, and work closely with secondary funds to optimize between these two competing objectives. How a GP manages this trade-off is, in our view, going to be THE key defining quality of "sought-after" GPs in India in the coming decade.

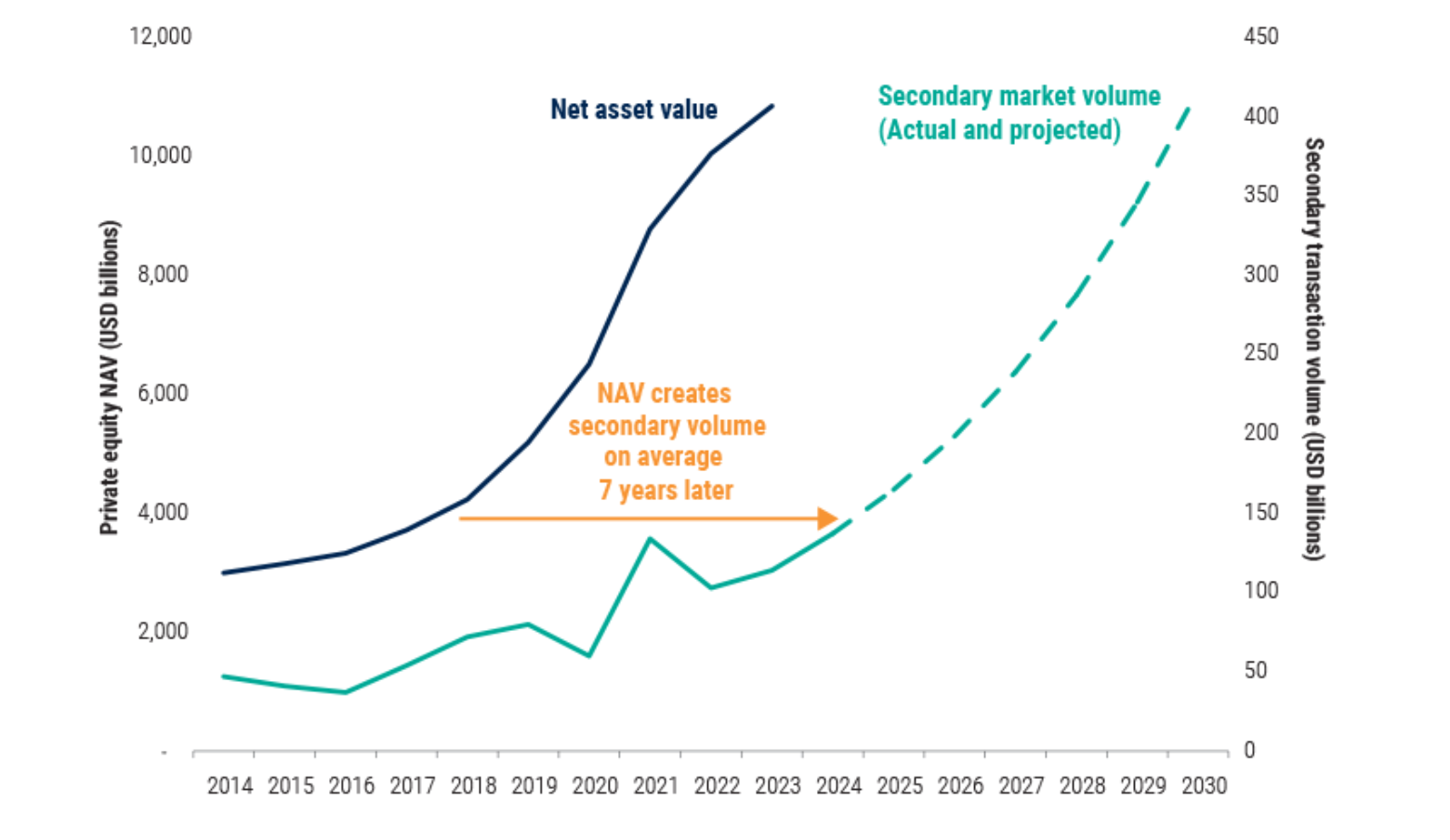

Source:https://www.pinebridge.com/en/insights/could-the-private-equity-secondary-market-triple-in-5-years

Maturing of the market

We firmly believe India and SE Asia have now hit critical mass in terms of number of high-quality entrepreneurs, scaled late-stage companies funded by PE/VCs, and also in terms of number of funds that are nearing end of life and, therefore, could benefit from well thought out secondary solutions. As early practitioners in this market as a team, we have not only seen the market evolve from its nascency, but we've ourselves have played our part in building this market from first principles. And with it, our conviction has only grown. We believe the secondary market in Asia which earlier somewhat monolithic, with few "one size fits all" funds, will become increasingly sophisticated, and open up opportunities for multiple specialized strategies to deliver liquidity to GPs.

Types of Secondary solutions and evolution of the market in India

The 2 key features that define and differentiate a secondary strategy is its philosophy towards

a) directs vs portfolios, and

b) quality vs discounts. With this in mind, we share our view of how the industry has evolved, and where it is headed:

| Feature | Secondaries 1.0 (2010-) | Secondaries 2.0 (2016-) | Secondaries 3.0 (2024-) |

|---|---|---|---|

| Seller Type | LPs in funds | Fund GPs | Fund GPs |

| Type of Sale | LP fund stakes, typically within a basket of several other fund commits | Mainly portfolios, with some single asset directs | Increasingly more single asset directs / portfolio carveouts |

| Access to portfolio | Negligible | Strong set of portfolio information | Full, primary-like access |

| Ability to select assets | Negligible | Limited | High |

| Pricing | High discount to NAV | Low-mid discount to NAV | Bottom-up valuation based on full info |

In short, secondary transactions are going to get "closer to the asset", with deeper access to information and management. In sync with this, "on the ground" fund managers who have deep networks with GPs and founders, and who have the capability to navigate complex multi-party transactions and structures, will increasingly emerge and take a lead in this space.

We are confident all 3 models will continue to evolve and will co-exist in India. GP liquidity needs come in all forms, and every kind of solution will find its application.

Our preferred approach to secondaries

"When we back-test the performance of our funds, most indicative of the return is not what we pay, but what we buy"

- Wilfred Small, Senior Managing Director, Ardian

Our philosophy on secondaries is simple:

a) bias for quality,

b) invest only in situations where we have deep access,

c) be the founder's go-to team for all things corporate finance (IPO, M&A), and

d) efficient transaction execution. Along the way, we will evolve with the market as much as co-create it.

Conclusion

Our mission is clear: the Indian PE/VC industry, in general, does not face a “value creation” problem, but does face a “cash flow mismatch” problem. We are building out the Kenro platform, brick by brick, to play a leading role in solving this mismatch.

#TheContext by IVCA – features opinion makers from the alternate investing industry with strong focus on India as investment destination. Watch this space for viewpoints on investment themes, emerging trends, economic analysis and latest industry insights.