#TheContext

Semi-Liquid Funds: Innovative Way to Access Private Credit Market

Priyam Kedia

The Private Credit market has been growing at a fast pace across the globe; however, investors often hesitate to access the Category II private credit alternative investment fund (AIF) market due to 12 to 18 months investment period caused by multiple capital calls and five-to-seven-year lock-in of funds.

Semi-liquid funds are an innovative investment vehicle in illiquid private credit markets for investors while getting the flexibility to subscribe and redeem at regular intervals. Specially crafted for HNIs/UHNIs and family offices, these funds are structured as open-ended vehicles and are ideal for investors who are unable or unwilling to invest in closed-ended funds (Category II funds) due to lack of interim exit options.

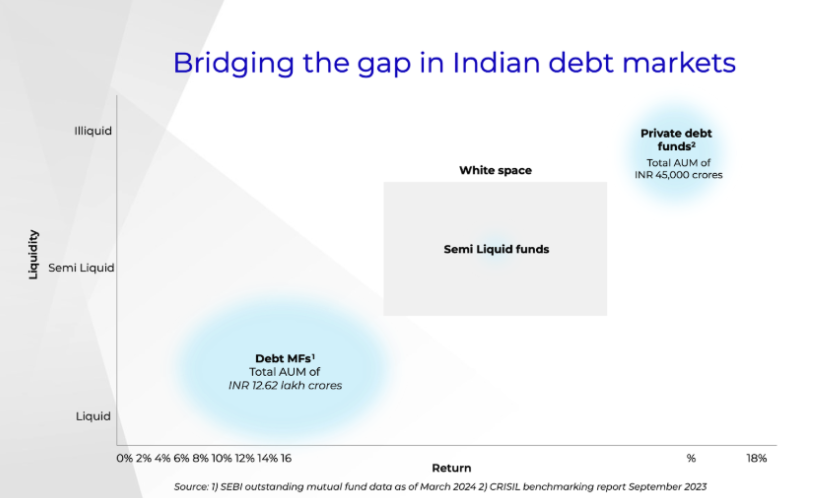

The term “semi-liquid” implies that the funds provide some degree of liquidity via periodic redemptions allowing investors to retrieve part or whole of their investment at periodic intervals providing more flexibility than traditional closed-ended funds (like Category II private credit AIFs). With these, semi-liquid funds effectively bridge the gap between liquid debt mutual funds/ FDs and the illiquid private credit market. The origin of semi-liquid funds can be traced back to 1992 when the Securities and Exchange Commission (SEC) in the US recommended the creation of a new form of open-ended investment vehicle known asInterval Funds. The momentum in interval fund launches began in 2018 and it is estimated to have cumulative assets under management (AUM) of ~US$1 trillion globally. Notably, credit strategies dominate the semi-liquid funds in the US, with credit being 66% of the overall AUM under interval funds (like Semi-Liquid funds/ perpetual vehicle).

The origin of semi-liquid funds can be traced back to 1992 when the Securities and Exchange Commission (SEC) in the US recommended the creation of a new form of open-ended investment vehicle known asInterval Funds. The momentum in interval fund launches began in 2018 and it is estimated to have cumulative assets under management (AUM) of ~US$1 trillion globally. Notably, credit strategies dominate the semi-liquid funds in the US, with credit being 66% of the overall AUM under interval funds (like Semi-Liquid funds/ perpetual vehicle).

Advantages of Investing in Semi-Liquid Structures

Access to private credit using innovative structure: Amid higher demand for private credit, demand for innovative structures like semi-liquid is expected to grow due to their open-ended setup giving investors access to the private credit market through a single drawdown and a flexible redemption and cash flow, basis investor’s need .

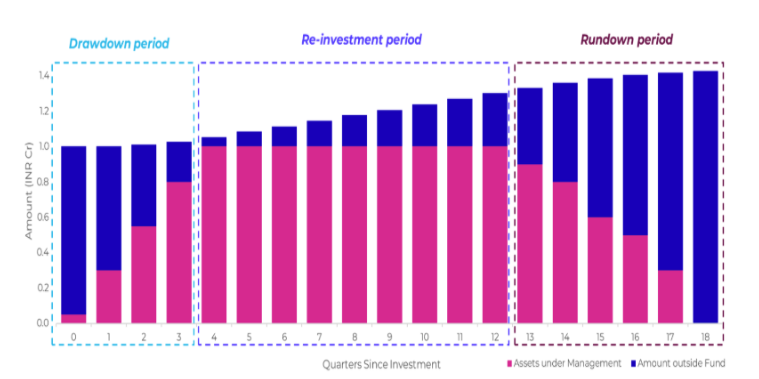

Further, returns from semi-liquid funds are not prone to opportunity loss or re-investment risk caused by multiple capital calls and cash distributions of income (irrespective of whether investor needs) and principal run-down in tranches, which exposes the investor to re-deployment and re-investment risk .

In traditional private credit funds, which are generally close-ended, actual returns from the date of commitment may differ from what was communicated. As per estimates, the overall drag can be 0.5-1% p.a., on a pre-tax basis, in investor’s actual returns.

In semi-liquid funds, gross returns are generally 1–1.5% lower compared to traditional private credit funds. However, the aforementioned cash drag with traditional private credit funds causes net returns (post-expenses, post-tax) from semi-liquid funds to be comparable to those from private credit funds, as semi-liquid funds begin generating returns for investors from the day the entire committed capital is invested.

Liquidity and flexibility: Semi-liquid funds are attractive to investors keen on entering the private credit market while enjoying periodic redemption / exit option. These funds enable faster deployment of investors’ capital (unit allotment can happen every fortnight) providing them with” off the shelf” product availability. Usually, the overall redemption, allowed every quarter, is capped at 5-10% of AUM, and there is no cap on exit at the investor level.

Further, semi-liquid funds allow investors to reinvest their income automatically into newer investments, if they choose to do so. If not, they can opt for quarterly interest payment.

Relief of wealth advisors: Wealth advisors need to perform due diligence on the fund manager, fund strategy for traditional closed-ended private credit funds repeatedly with every commitment. However, semi-liquid funds relieve them from doing so by underwriting upfront instead of continuously engaging in a new process every time.

Operational ease: In Semi-liquid funds, capital investment takes place in a single tranche avoiding the need for periodic capital calls likewise in a traditional fund. This makes operations simpler for investors and their advisors/private bankers.

Conclusion

Semi-liquid funds are gaining traction globally for good reasons. It offers a better value proposition than traditional private credit funds. Private Credit as an asset class is well suited to investment through a semi-liquid structure. Off the shelf availability and periodic liquidity distinguish semi liquids from traditional private credit funds. Availability of semi-liquid structures in India’s alternative industry are expected to increase over time.

#TheContext by IVCA – features opinion makers from the alternate investing industry with strong focus on India as an investment destination. Watch this space for new announcements in the sector, viewpoints on investment themes, emerging trends, economic reports and latest industry insights. Content in this section is curated by team IVCA. To share feedback, connect with paromita.sinha@ivca.in